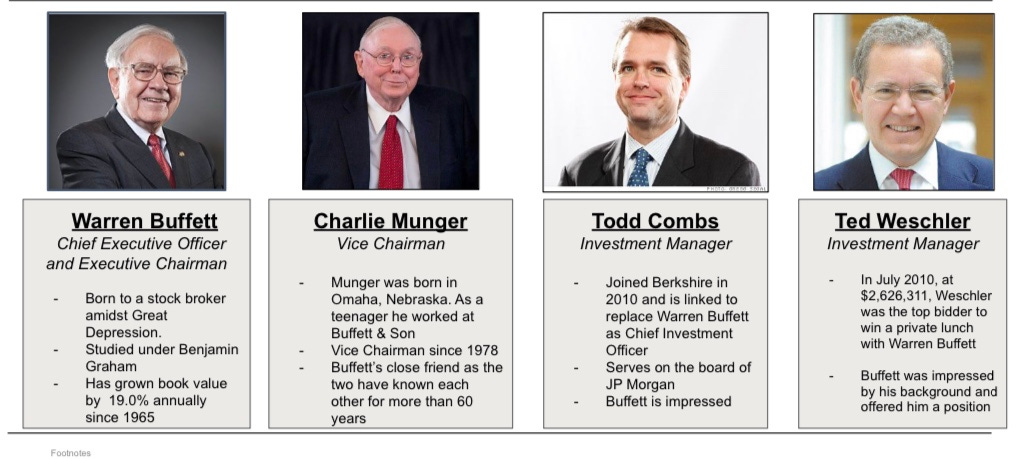

Berkshire Hathaway founded by the Legendary Warren Buffett and co managed by Charlie Munger is currently at the helm of 4 wonderful managers namely , Ajit Jain who manages the insurance business, while Greg Abel operates any business that are not related with insurance. In addition, Todd Combs and Ted Weschler who manage about $15 billion each

We are more interested to know about what Todd Combs and Ted Weschler are doing at Berkshire and how have they turned the investment philosophy at this Legendary firm from Value Investing to one that of Growth Investing in recent times.

To begin with Berkshire didn’t have too much exposure to Technology and healthcare businesses, they were more focused on financials and buying stocks of beaten down companies. The mantra was to buy “fair business at a wonderful price” , but since Todd and Ted have taken over a large portion of fund management at Berkshire, the slogan now has shifted to buy “wonderful business at a fair price,”

Some the Stocks which Berkshire has reported holding in their portfolio as of June 2020 is namely…

Apple , Amazon , Precision Castparts , Paytm, Stone Co Ltd , Kroger , RH ( Restoration Hardware), Biogen , Teva Pharma , DaVita Healthcare , Charter Communications, VeriSign Inc , General Motors , Costco Wholesale Corp, Liberty Media , Globe Life , Axalta Coating Systems , Store Capital Corp , Synchrony Financial, Liberty Global plc , Suncor Energy,

Warren Buffett has made his share of mistakes in recent times and has rightly passed on the baton of running the Berkshire conglomerate into the hands of Todd and Ted , though it’s not official as I write this article today

Todd Combs and Ted Weschler have had better records than Buffett in recent years with large bets especially in Apple and Amazon stock which have returned manifolds since Berkshire took large positions and exited partially.

Todd Combs has also taken over as CEO of GEICO from 01 January 2020 , a position widely seen as additional responsibilities before he finally takes over Buffett at Berkshire Hathaway

Buffett himself has said “ Todd and Ted have made Berkshire billions already that we wouldn’t have otherwise made,”

Some experts have pointed out “Todd Combs tends to get in and out of stocks much faster than Buffett. Ted Weschler prefers to buy and hold a few stocks for a long time.”

Both were former Hedge Fund managers , Combs and Weschler run their portfolios autonomously, though for compliance reasons they do have to inform Buffett of their selections in advance.

Todd Combs and Ted Weschler have made some very good investments at Berkshire. Both seem to have a knack for catching stocks near their lows.

Weschler started his journey at Berkshire with the purchase of oil company shares Suncor and Combs started his journey with MasterCard

Weschler is on the lookout for smaller companies and new takeover targets. He also keeps an eye on European countries,

Both executives operate according to the “punch card investing” method that’s Buffett's favorite. The star investor advises people to approach investing as if they each had a punch card that permitted only 20 decisions over an entire lifetime

Howard Buffett ( Warren Buffett’s Son) is expected to head the administrative board and will monitor Berkshire's company values and culture in the future after Warren’s departure

Ted Weschler keeps away from the hectic activity of Wall Street. His office is above a bookstore in the city of Charlottesville in Virginia. He doesn't even bother with a nameplate on the door. . He likes to keep a low profile and has categorically stated he is not the choice for the post of CEO at Berkshire Hathaway after the departure of Warren Buffett.

The Oracle of Omaha turned 90 at the end of August 2020, and Buffett himself has acknowledged the need for new blood at Berkshire Hathaway. To that end, he has installed two senior portfolio managers, Ted Weschler and Todd Combs, to steer the investment management side of the company going forward.

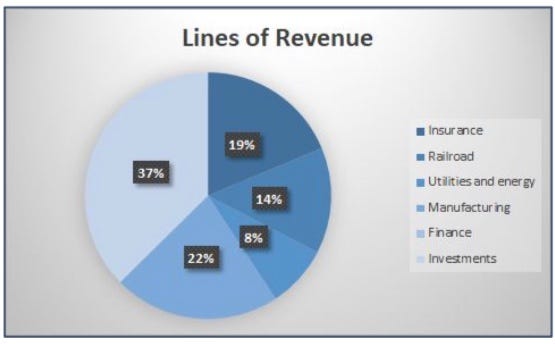

Buffett is bullish on that move, calling the rise of both Weschler and Combs “one of the best moves” the company has ever made. Together, they’ve built a broadly diversified investment portfolio of subsidiary companies across myriad industries, as well as stock holdings in dozens of companies — all under the sturdy roof of Berkshire Hathaway.

Is Berkshire Hathaway a safe Stock to buy in 2020

The Class A share is currently selling at $327000 and Class B share at $218

The Stock has underperformed this year losing about 6% , despite holding $146 Billion in cash and cash equivalents

In Q2 2020 , Berkshire Hathaway reported a massive 86.5% increase in earnings year over year. The $26.3 billion the company reported in net earnings was driven by $34.5 billion in investment gains, reflecting the strength of Berkshire Hathaway’s investment portfolio.

Though it was Apple ( #AAPL) which has been the largest contributor with around 45% of Berkshire Hathaway’s investment portfolio dedicated to Apple, where Berkshire Hathaway is now its second-largest shareholder.

Also Berkshire Hathaway took a whopping $9.8 billion impairment charge for Precision Castparts, maker of aerospace components — nearly a third of what Berkshire paid to acquire the company in 2016.

#BRK certainly won’t be on the list of growth investors anytime soon; its massive size severely limits its rate of growth, and it currently has more than $146 billion in cash that’s languishing, sitting in extremely low-interest-bearing instruments like Treasury bills.

Berkshire bought back more than $5 billion of its own shares in Q2 2020 , and analysts estimate that buybacks will continue into the Q3 and Q4 as well — indicating that the company is undervalued according to Buffett.

#BRK stock is a great for value investors with long-term horizons, but not so much for aggressive traders seeking high returns.